Ukrainian exports have faced unprecedented challenges and have been going through very difficult times for the last year and a half. Closed air traffic, broken logistics and crucial drop in GDP led to the reduction in exports of goods after February 2022 by 35% — to a total of $44.2 billion. Moreover, the raw structure of Ukraineʼs exports is getting more and more distinct. Yet almost three quarters of it falls on the supply of agricultural products and natural minerals from Ukrainian subsoil.

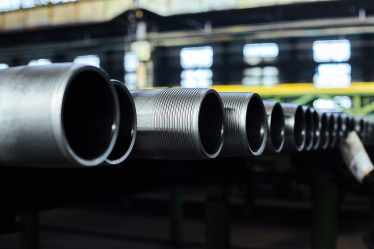

But while the whole world was following the developments in Black Sea Grain Initiative there is another side of Ukrainian exports — industrial goods with added value. And here Ukrainian enterprises do their job well. Despite all the difficulties they continue to deliver goods to the EU, Asian, African and the US markets. For example, Interpipe, a global producer of steel pipes and railway products based in Ukraine, firmly holds its position not only in Europe and the USA, but also in such a tough region as the oil and gas basin of the Persian Gulf which imposes the highest requirements in the world to products. The full-scale Russian-Ukrainian war definitely made some adjustments to the companyʼs export strategy — these changes affected the volume of exports, their geographical distribution, as well as relations with partners.

Before the Russian invasion, Interpipe had big plans primarily for Gulf states and Turkey — the company won several important long-term tenders, supplied products and successfully developed in these regions. But the partners reacted differently to the start of the full-scale war and the associated risks of supplying pipes from Ukraine, especially, constant shelling of Nikopol which is located in the frontline area.

Some large oil and gas companies took seriously these risks and practically stopped buying Ukrainian pipes, while partners from the construction industry in Saudi Arabia, the UAE, and Qatar continued to cooperate with the Ukrainian company. Although sales volume decreased by 1.5-2 times Interpipe still maintained its presence on the market.

Artem Artemov

Pipe Sales Director for MENA markets at Interpipe

THE MIDDLE EAST, AFRICA, TURKEY, SOUTHEAST ASIA

The geographical distribution and product portfolio in this region changed a lot due to the full-scale war.

The main challenge was the oil and gas sector which is strategic for us in the region. The problem was that the work with large oil and gas state-owned companies which used to be a significant part of our book order has slowed down significantly. These companies have certain internal procedures and guidelines that recommend not to work with suppliers from countries at war. They protect themselves from the risks of supply disruptions which can threaten them with huge financial losses, especially during times of increased demand for petrochemicals.

Additionally, after the beginning of Russian invasion the already shaky economy of Egypt went into a steep dive. Hyperinflation and the fall of the Egyptian pound pushed the state to introduce currency regulation, which is still in effect today; so, imports have practically stopped. At the same time, Egypt was one of the most important markets in the Middle East for Interpipe given our historical presence and dynamic growth in recent years.

The main segment where we are supplying products now is construction, its main product is linepipes. The four main sales markets are the United Arab Emirates, the Kingdom of Saudi Arabia, Turkey and Qatar.

However, we see that due to the successes of Ukrainian army, the situation with customers is improving. Categorical positions regarding the impossibility of supplying products before the end of the war are softening, and today we are already finding small compromise solutions. We are not offered big tenders and contracts yet, but we are already being considered as an additional supplier, we have already closed several small deals this year.

Our biggest advantage is flexibility. Our production, regardless of the size of orders and production batches, remains efficient. Even in times of high demand, when all our enterprises are overloaded, we find solutions to organize production and support regular customers. We deliver products quickly and are competitive in price. This is possible thanks to the excellent work of our production services, as well as constant investments in production, which improve the cost price and allow us to expand the range of manufactured products.

Another advantage we have over our main competitors from China is after-sales service. We try to receive feedback, constantly meet with customers, improve products based on their wishes or claims. And they appreciate it. We are more reliable, ready to compromise and support even when we have more economically feasible directions for product sales.

Interpipe strive to be a supplier of premium products to the largest oil producers in the Middle East.

I would call our market a family one — relationships are very important. Every year, we held client conferences where we invited our partners, showed them our production units, our R&Ds and innovations, and introduced them to Ukrainian culture. We try not to have economic relations with our clients, but something more — partnership, friendly, long-term relations.

Our strategy was determined even before the war — to enter the segment of premium gas-tightness connections for hydrocarbons production. Under this strategy a project to expand production capacity is being implemented specifically for these purposes. Naturally, such product has a higher added value which enables us to compete more effectively with countries with an aggressive price policy, primarily, China.

The most challenging moment of further development today is quite trivial — it is a physical audit of the production sites, checking of technical processes, documentation, resources in production that is now extremely difficult to organize. We offer online audit and to delegate authority to independent qualification companies.

Several customers have announced their prior consent, so our plan remains unchanged.

Our goal is to become a supplier of premium products in the region and serve the largest oil producers in the Middle East and North Africa — Saudi Arabia, Oman, Qatar, Emirates, Kuwait, Iraq and Egypt.

Ivan Mazanka

Sales Director for European markets at Interpipe

EUROPE

Last year, the European Commission provided great support to Ukraine — temporarily suspended all quotas and duties on Ukrainian goods, including steel pipes. We used this to partially offset the logistics costs. But there were even more bonuses: the absence of quotas allowed Interpipe to develop in the European market, search for and enter new niches.

First of all, itʼs about new unique types of pipes for mechanical engineering. We need a lot of work to produce them correctly but itʼs worth it because they have a lot of added value. Interpipe has already mastered more than 100 types of new products for European market and plans to establish the production of up to 200 more.

For example, such new product for Interpipe is axles for trucks. In fact, this is a unique pipe product. Another example: our client Liebherr needs a pipe 14 meters long. Now there is no such transport that makes it possible to deliver a 14-meter pipe to Europe. So, it is a matter of cooperation between our engineers and logistics specialists. Generally, becoming a supplier for well-known European companies is not easy. Each company has its own requirements and standards. Working according to these standards is one challenge, but small niches with high-quality products, which also require intelligence, are a completely different level.

Another interesting segment for Interpipe is the EU OCTG market. According to various forecasts, it could grow 5 times due to the EUʼs demand for energy, but now its volumes are small and we do not record any increase. Additionally, geothermal drilling is gaining popularity in the EU, i.e. the extraction of warm water from the depths to heat not only houses, but also entire cities. We see great prospects in this segment, but now its volumes are also small.

After the beginning of the war, many European companies expressed their support for us and said that we are already Europe.

Of course, at first some hesitated and had certain doubts about how cooperation with Interpipe would turn out, but now they are confident in us, because we have proven that Interpipe is a reliable supplier.

Вы нашли ошибку или неточность?

Оставьте отзыв для редакции. Мы учтем ваши замечания как можно скорее.